Closing Costs – The Rundown

Closing Costs are simply processing fees paid to your lender. These fees are the charges for creating your loan and cover things like your appraisal and searches on your homes title. Your specific costs will depend on the type of loan you have and your location.

So How Much Are They?

Most of the time closing costs are about 3 to 6 percent the price of the home. Your down payment on the home is not included in this, but that can be negotiated. Closing costs don’t include your down payment, but can be negotiated. You can negotiate with your seller to cover your closing costs, but this will depend entirely on who you are buying from and where the market stands at time of closing.

If you’re the buyer

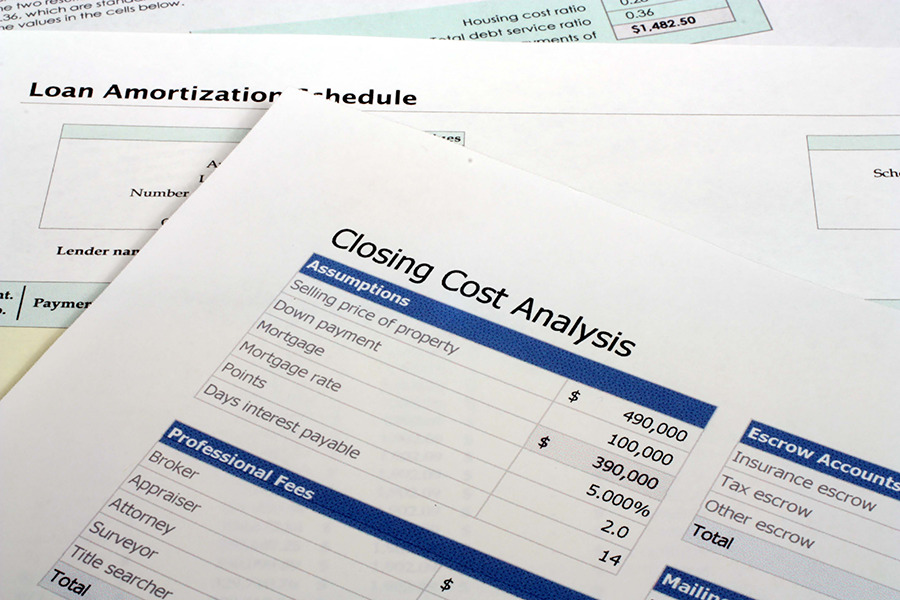

Each buyer will have a different amount depending on lender requirements, government requirements, and more. Once again your location and type of loan will determine what you need to pay. Before your closing meeting you will receive a document called a Closing Disclosure explaining each closing cost in detail. You might see things like, Attorney Fees, Appraisal Fees, Credit Reporting Fees, and more.

If you’re the seller

As the seller, you need to help finish the loan with some payment contributions as well. You’ll need to close out any HOA Fees, pay a commission you’ve predetermined with your real estate agent, and you may see Escrow and Attorney fees as well.

How Can I Calculate Possible Closing Costs?

When house hunting, prepare to have the 3 to 6 percent of the home price in your budget when you are house hunting. Read up or work with your real estate agent/lending team to learn about any additional property taxes or state fees.

When do I pay closing costs?

Most of the time closing costs are paid during your closing meeting when you sign final paperwork and recieve the keys to become the official owner of your home. The lender will accept your down payment and all costs during this meeting.

Closing Cost Closing Thoughts

The bottom line is that closing costs for your specific home purchase will depend on the type of loan you have, the value of your home, and the laws of your home state. Sellers, be prepared to negotiate or pay the price of closing costs, as many buyers may include this as a request upon the sale of your home. Decide whether it makes sense for you to cover these costs in your sale and stay firm.

Buyers, you might be able to save on your closing costs by negotiating with your lender. You may also want to ask your seller to pay a percentage of your closing costs or take a no-closing-cost loan. In addition to your funds, make sure you review everything you need to bring to closing.